In the ever-evolving landscape of finance and investment, the pursuit of returns on investment (ROI) has become a guiding star for both seasoned investors and novices alike. Yet, unlocking the true potential of ROI is not merely about crunching numbers or following market trends; it’s about discerning the nuances, recognizing patterns, and making informed decisions that transcend conventional wisdom. In this article, we delve into the art and science of smart investment strategies, exploring the critical factors that can elevate your investment acumen. By examining the strategies, tools, and insights that can enhance decision-making, we aim to empower you to navigate the complexities of the financial realm. Join us as we unlock the secrets to achieving robust ROI, guiding you on a path toward clever investment choices that align with your financial aspirations.

Understanding the Value of ROI in Modern Investment Strategies

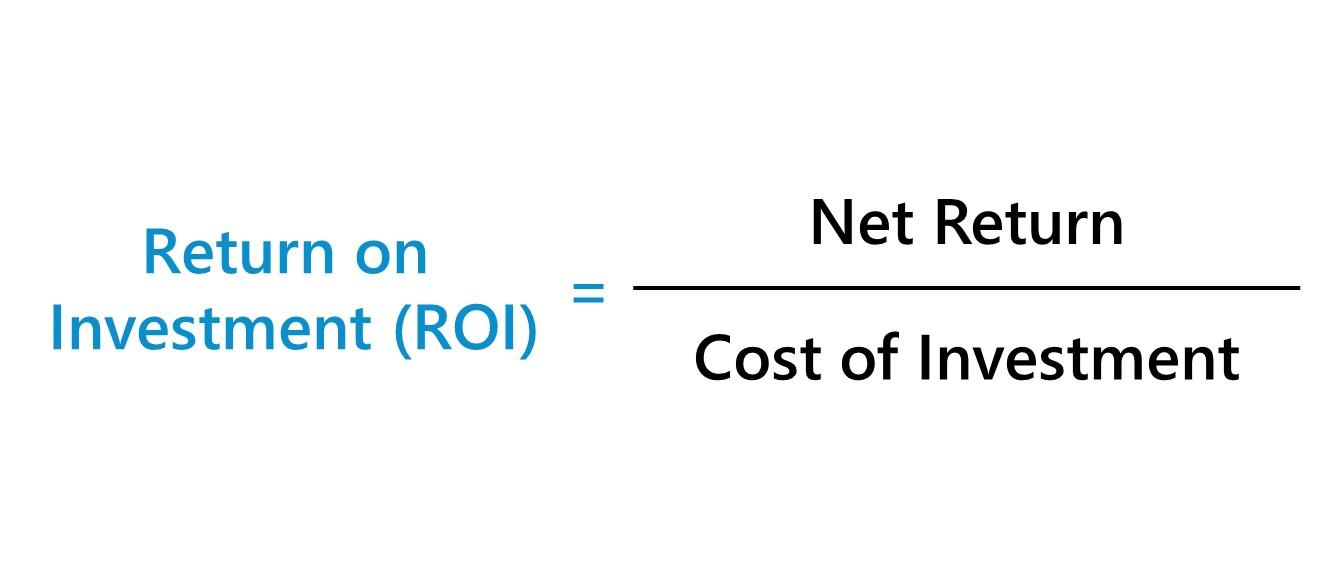

In today’s fast-paced financial landscape, understanding the concept of ROI—Return on Investment—has become paramount for savvy investors. It serves as a crucial metric that allows individuals and businesses alike to gauge the effectiveness of their investments, enabling them to make informed decisions. The significance of calculating ROI extends beyond mere numbers; it encapsulates a holistic understanding of potential returns, risks, and the overall health of investment strategies. By focusing on ROI, investors can prioritize opportunities that offer the best potential yields while steering clear of less favorable options.This strategic approach fosters a culture of accountability and transparency,vital elements in modern investment practices.

Moreover, ROI isn’t just a static measurement; it evolves with market conditions and innovations. To stay competitive, investors are encouraged to continuously analyse their ROI in relation to various factors, including:

- Market Trends: Adapting to shifts in consumer behavior and economic indicators.

- Portfolio Diversification: Evaluating how different assets contribute to overall returns.

- Timing and Strategy: Assessing the impact of entry and exit points on ROI.

To put this into perspective, consider the following table showcasing hypothetical ROI scenarios across different investment types:

| Investment Type | Initial Investment ($) | Expected Return (%) | Calculated ROI (%) |

|---|---|---|---|

| Stocks | 10,000 | 8 | 800 |

| Bonds | 10,000 | 5 | 500 |

| Real estate | 10,000 | 12 | 1,200 |

Identifying High-Potential Opportunities for Maximum Returns

When navigating the complex landscape of investments, it’s crucial to pinpoint areas that promise the highest returns.start by assessing market trends and identifying sectors that are gaining traction.Look for innovative companies that are poised for growth due to technological advancements or shifts in consumer behavior. Key indicators to monitor include:

- industry Growth Rates: Analyze sectors with above-average growth projections.

- Competitive Advantage: Seek businesses with unique offerings or patents.

- financial Health: Review balance sheets for positive cash flow and manageable debt.

Utilizing a structured approach can further enhance opportunity identification. Create a risk-reward matrix to evaluate potential investments systematically. Categorizing opportunities allows for a clearer assessment of overall viability. Consider the following criteria when mapping potential opportunities:

| Criterion | Description | Potential impact |

|---|---|---|

| Market Demand | Growing consumer interest in specific products or services | High |

| Regulatory Environment | Government policies that support or hinder business growth | Medium |

| Technological Advancements | Technology that enhances operational efficiency or consumer engagement | Very High |

Leveraging data Analytics to Enhance Decision-Making

In today’s data-driven world, organizations are discovering the transformative power of analytics to make informed decisions that elevate their performance. by systematically analyzing past data and identifying trends, companies can not only anticipate market shifts but also craft tailored strategies that align with consumer demands.This approach not only fosters agility but also creates a competitive advantage that can led to increased profitability.

To effectively harness these insights, businesses should focus on key metrics and employ advanced tools that facilitate extensive data analysis. Consider implementing the following strategies:

- Data Visualization: use graphical representations to simplify complex data sets, making patterns easier to recognize.

- Predictive Analytics: Leverage historical data to forecast future trends, allowing for proactive adjustments in strategy.

- Customer segmentation: Analyze customer behavior to develop tailored marketing campaigns that resonate with specific audiences.

| Analysis Type | Purpose | Benefits |

|---|---|---|

| Descriptive | Understand past performance | Informed baseline strategies |

| Diagnostic | Identify reasons for past outcomes | Enhanced performance recognition |

| Prescriptive | Suggest actions for future scenarios | Optimized decision-making |

Cultivating a Resilient Investment Mindset for long-Term Success

In the ever-evolving realm of investments, developing a robust mindset is crucial. Embracing adaptability allows investors to navigate market fluctuations with confidence. This involves acknowledging the potential for unexpected challenges and being prepared to pivot strategies when necessary. A resilient investor understands that volatility is an inherent part of the investment landscape and sees it as an opportunity for growth rather than a setback. Key elements of this mindset include:

- Patience: Recognizing that true value takes time to materialize.

- Focus on Long-Term Goals: Prioritizing overall investment objectives over short-term gains.

- Continuous Learning: Staying informed about market trends and new investment strategies.

Moreover, incorporating a strategic approach can significantly enhance decision-making processes. It’s essential to remain grounded by routinely assessing the fundamentals of each investment and ensuring alignment with your long-term vision. Establishing criteria for evaluating opportunities can definitely help mitigate emotional decision-making. Below is a simplified framework that can aid in maintaining a disciplined investment perspective:

| Criteria | Evaluation Questions |

|---|---|

| market Potential | does the business have room for growth? |

| Financial Health | Are the revenue and profit margins stable? |

| Management Team | Does the team have a track record of success? |

To Conclude

As we conclude our exploration of unlocking ROI, it’s clear that the journey of smart investment decisions is a nuanced one, blending art and science in a delicate dance. By understanding the intricate mechanics of return on investment, investors can navigate the complex financial landscape with confidence and clarity.

The key takeaway is not just about crunching numbers but also about cultivating an intuitive approach to investment that aligns with your unique goals and values. Embrace the tools and strategies we’ve discussed, remain adaptable in the face of change, and always keep an eye on the horizon.

In a world where opportunities abound and risks are ever-present, the ability to unlock ROI can be the difference between mere participation and achieving financial success. As you embark on your investment journey, remember: knowledge is your best ally, and informed decisions pave the way to a brighter financial future. Happy investing!